The Outlook For Investors

Published Friday, October 27, 2023 at: 7:41 PM EDT

Algorithms by staff economists at the two Federal Reserve district branches are forecasting twice the growth predicted by human experts.

Staff at the New York Federal Reserve District Branch and the Atlanta district branch both designed algorithms to predict the present growth rate of U.S. gross domestic product (GDP), and they are published on their websites. When the government releases employment, personal income or other components of GDP, the Atlanta Fed’s “GDPNow” algorithm, for example, updates its forecast to reflect the new data. Nowcasts for inflation and other key economic data are also sponsored by the Federal Reserve System.

Nowcasts demonstrate the Fed’s commitment to transparency and democratization of information as well as American exceptionalism. Empowering the 12 district branches to publish continually updated real-time estimates of U.S. GDP growth increases investor transparency of the statistics that drive investment prices.

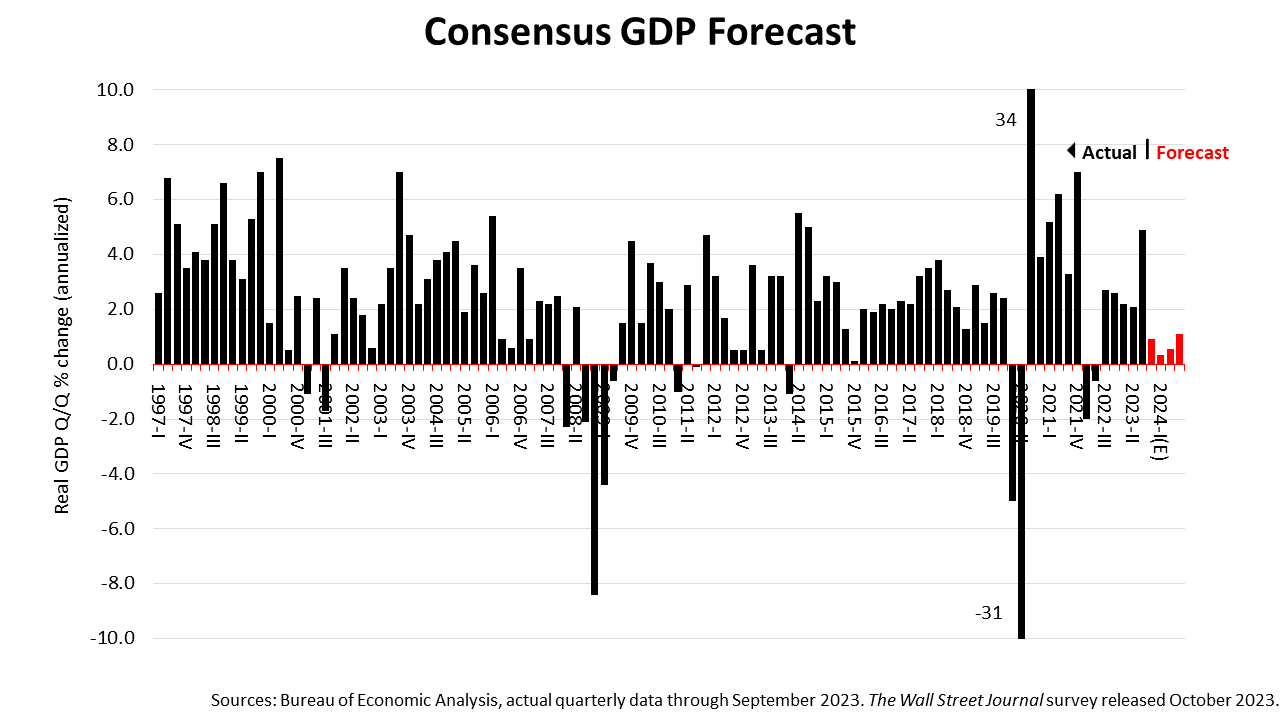

To understand the importance of Fed district branch nowcasts, consider this chart showing the consensus forecast of 60 human leading economists surveyed quarterly by The Wall Street Journal. They are predicting a growth rate a tick less than 1% for the fourth quarter of 2023 ending December 31. In comparison, the algorithm from the Atlanta Fed is projecting a 2.3% growth for the final quarter of 2023. The New York Fed’s nowcast is for GDP growth in the fourth quarter of 2.6%.

The point is that third-quarter growth came in at 4.9%, which was much stronger than human economists predicted. Economist Fritz Meyer says it’s hard to imagine the economy slowing to less than a 1% growth rate in the fourth quarter after a gangbuster 4.9% rate in the third quarter.

The nowcasts from the Federal Reserve district branches have been more accurate than human economists for many months and that could be what’s happening now. If the Fed algorithms are right, the expansion that defied expectations in the first three quarters of 2023 may fool the consensus of experts yet again in the fourth quarter and in 2024.

The strength of the economic data released this past week caused stock prices to weaken sharply. The stock market is usually an indicator of what will happen in three or four months, and investors appear to be concluding the strength of the economy could warrant another rate increase by the Fed or policymakers may decide to maintain high rates for longer to ensure inflation is no longer a serious threat.

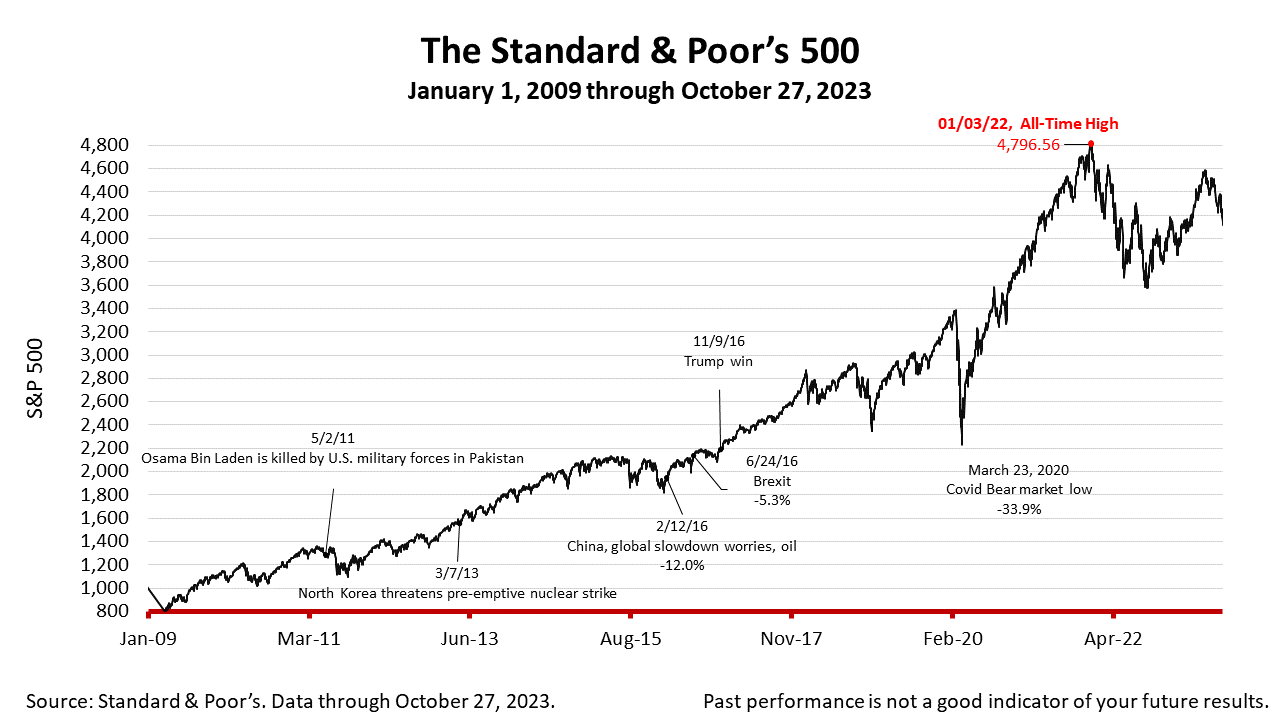

The Standard & Poor’s 500 stock index closed Friday at 4117.37, down -0.48% from Thursday. After losing 2.39% last week, the S&P 500 lost another -2.53% this past week. The index is up +84.02% from the March 23, 2020, bear market low and -14.16% lower than its January 3, 2022, all-time high.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding