Tax-Sensitive Investment Planning In 2023

Published Friday, August 11, 2023 at: 7:51 PM EDT

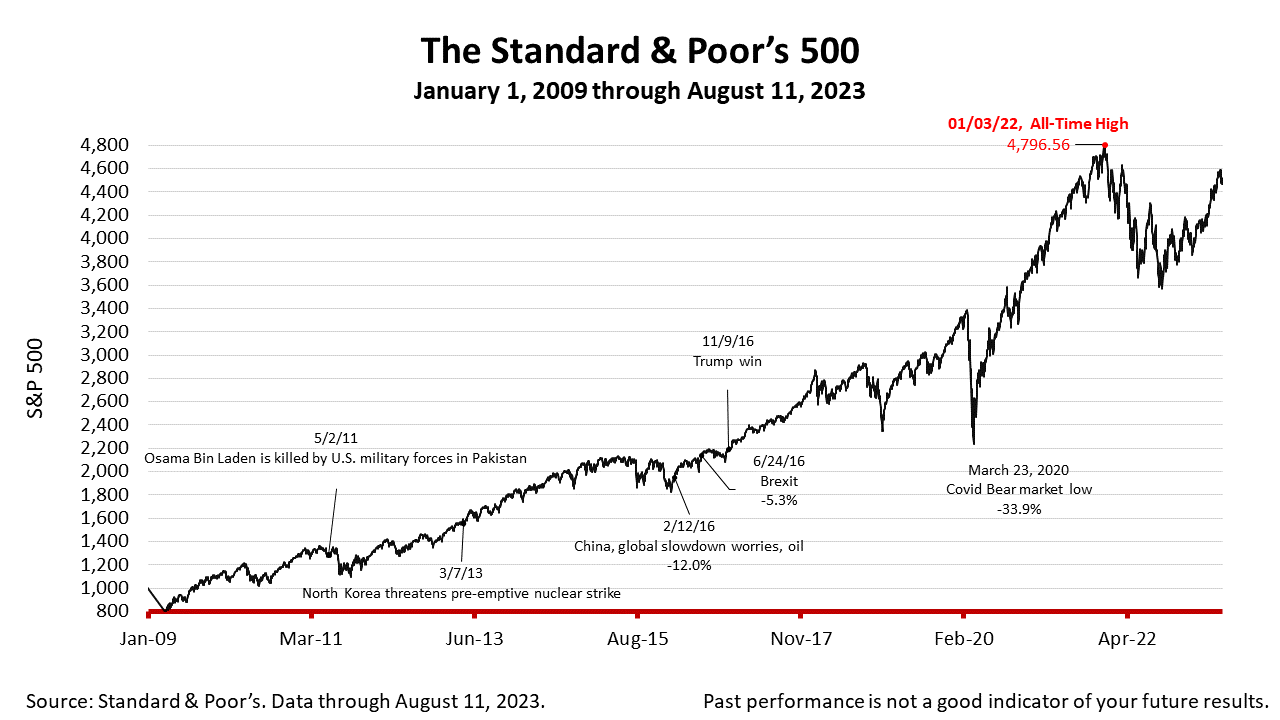

2023 is shaping up as an action-packed year for tax and financial planning maneuvers. With a 19.6% return on the Standard & Poor’s 500 stock in the first six months of 2023 and a much faster than expected 2.4% gross domestic product growth rate in the U.S. economy, stock prices and the economy have risen much more than expected.

The surprising gains on capital-gains producing assets, like stocks and housing, make this a good time to consider converting assets in traditional IRAs and taxable accounts to Roth IRAs. Conversions of investments in traditional IRA accounts to Roth IRA accounts involve selling investments that rose sharply in the first half of 2023 and will likely require paying income taxes on the sale proceeds.

However, if you believe Federal taxes are likely to rise in the next decade to finance the long-term U.S. debt, it’s wise to consider moving assets into Roth IRA accounts by the end of 2023 because Roth IRAs are not subject to income tax annually or upon withdrawal.

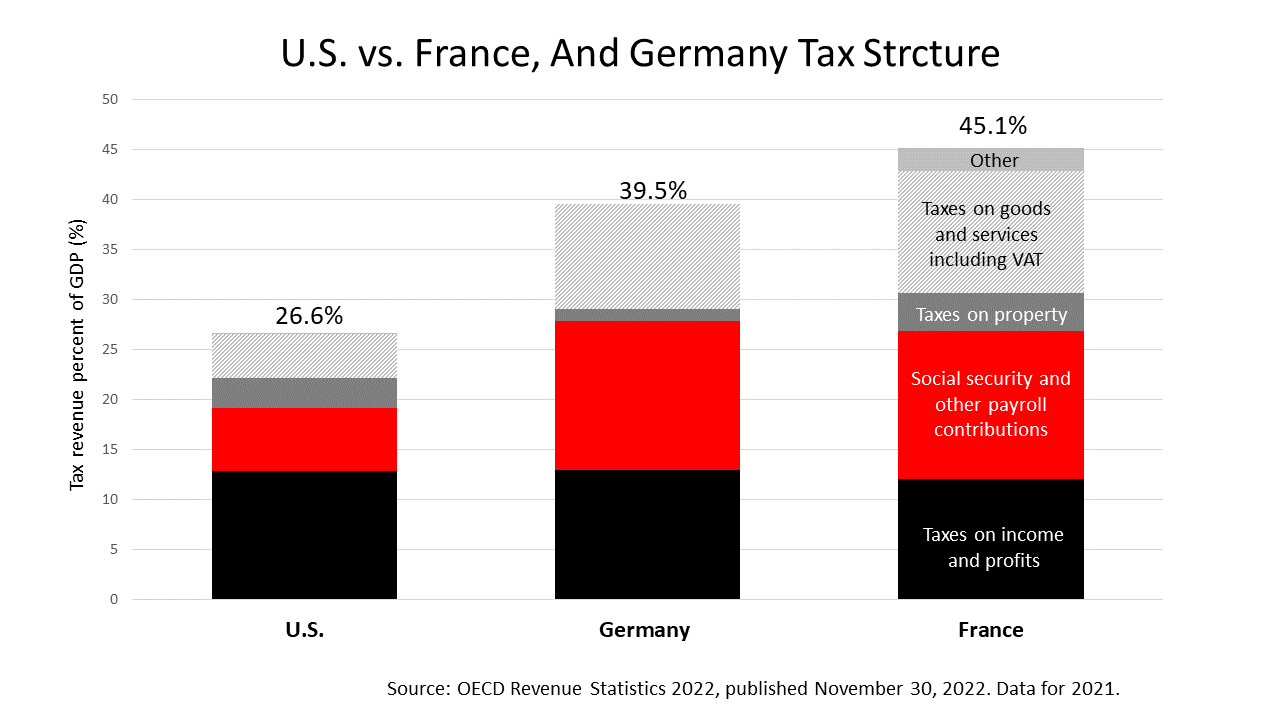

The U.S. long-term debt is expected to grow significantly in the next decade to pay for annual deficits and rising interest payments to fund Social Security and Medicare. Without government action, paying only the interest on the debt becomes unsustainable in about a decade and mushrooms out of control, according to the Congressional Budget Office (CBO), a non-partisan arm of the U. S. Congress. With U.S. tax rates compared to Germany, France, and other developed nations relatively low, a tax increase in the U.S. is likely.

A tax increase would make tax-free investments more valuable to a retiree. Converting taxable investments to Roth IRAs, which grow tax-free and generally are not taxed upon withdrawal in retirement, may make a lot of sense in 2023.

Selling profitable taxable capital investments before the end of 2023, and writing off any capital losses sustained this year, would free up funds for a Roth IRA account that generates tax-free income when you’re retired. This type of tax-sensitive investing is a way of boosting after-tax returns by strategically planning the location of your investments, so they’re held in accounts with the goal of optimizing after-tax income in retirement.

The Standard & Poor’s 500 stock index closed Friday at 4464.05, down -0.11% from Thursday, and -0.31% from a week ago. The stock index is up 99.52% from the March 23, 2020, bear market low and only -6.93% lower than its January 3, 2022, all-time high.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding