Planning Briefs

Equity Risk Premium Grew Wider And More Important

Published Tuesday, February 23, 2021 at: 10:09 PM EST

Modern portfolio theory holds that investors get paid extra return for taking risk. The concept is simple, but can be hard to implement without coaching and education, and it grew more important lately: Investors who take equity risk expect to earn extra return.

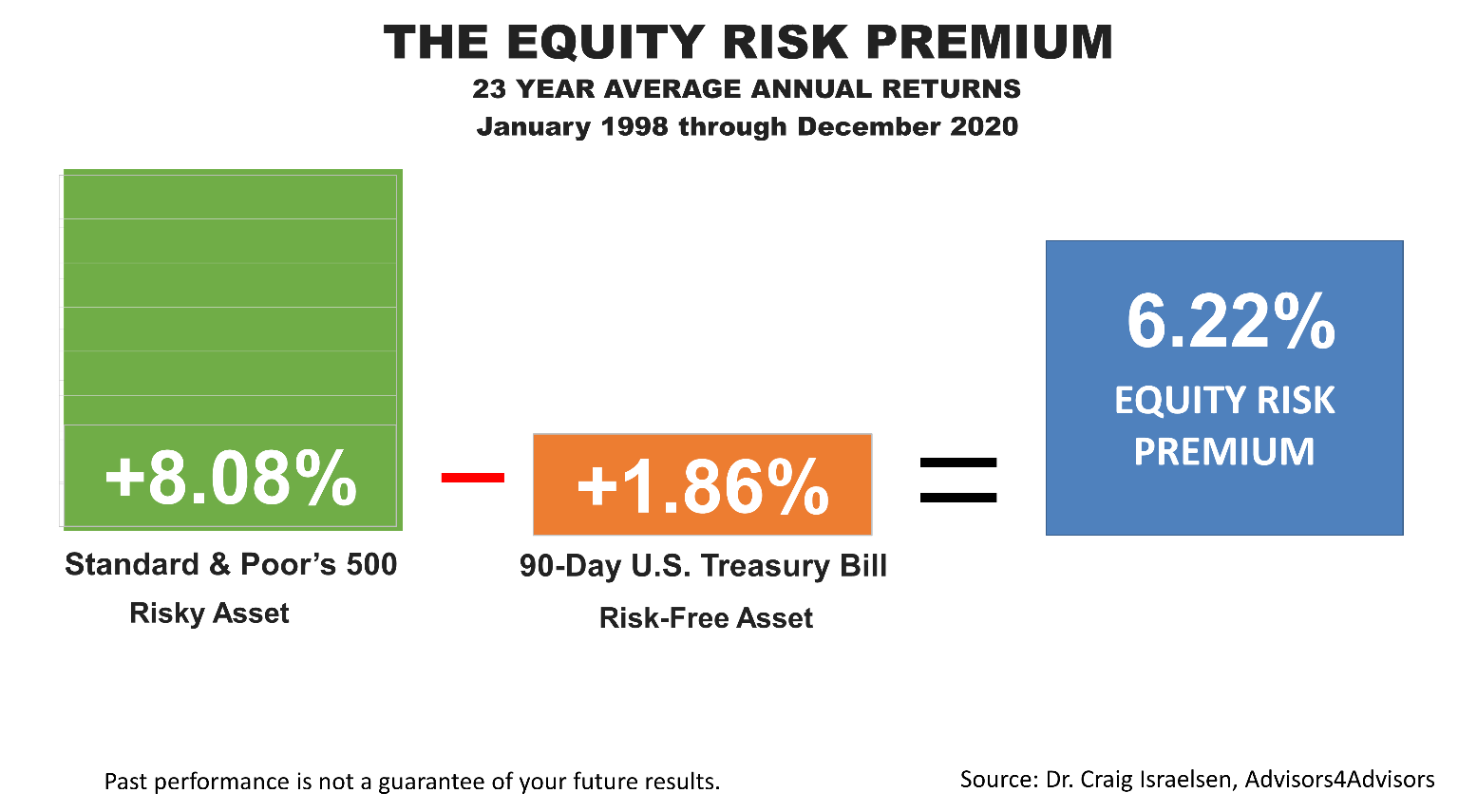

To quantify the risk premium of stocks, the amount you get paid for owning a risky asset, according to modern investment theory, here are the numbers: Over the 23 years ended on December 31, 2020, the risk-free 90-day U.S. Treasury bill averaged an annual return of 1.86%, compared to the 8.08% annualized return on the Standard & Poor’s (S&P 500) stock index. By subtracting the 1.86% return on the no-risk asset from the 8.08%, the resulting 6.22% annually earned on stocks over the boom-and-bust cycles since 1998 represents the equity risk premium.

To be clear, owning stocks through the tech bubble in 2000, financial crisis in 2008 and 2009, and COVID bear market rewarded investors with a premium of 622 basis points over what they would have earned by investing in a risk-free 90-day Treasury.

The equity risk premium fattened considerably in the last quarter, moving from 5.75% to 6.22% as the return on stocks improved while the 90-day Treasury bill remained incredibly low. Low Treasury bill rates and the $900 million federal economic stimulus and relief aid enacted in December have created a mountain of cash, driving up stock prices.

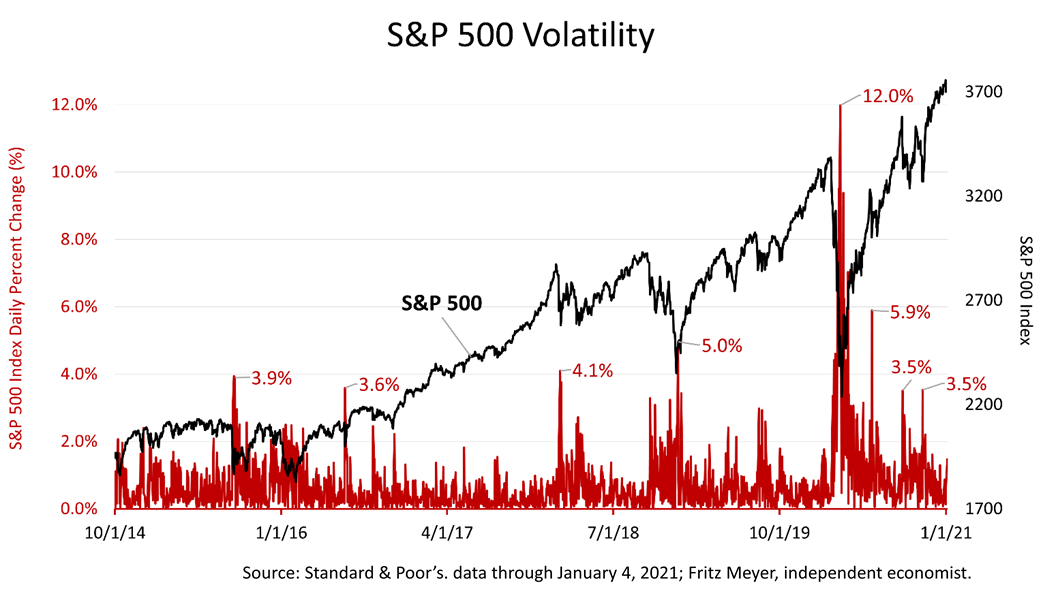

This chart better illustrates the risky aspect of the equity risk premium. The red data series shows the daily changes in the stock market prices, as represented by the S&P 500. Big one-day drops of between -3% and -5% are not uncommon in recent months, and, earlier in 2020 , stocks plunged -12% in a single-day! So, indeed, earning the equity risk premium is hard and scary at times. Armed with these kinds of statistics, which show that big daily plunges do come frequently, may make it easier to withstand the uncertain times.

With the COVID outbreak continuing and the worsening hospitalization rate across many states, the risk of a stock market plunge should have been expected, but retirement investors – permanent investors who plan to own stocks for the rest of their lives – were wise to view volatility as a friend. That's a different way of looking at the world, but it absolutely is valid.

Choosing to expose a portion of your portfolio to price volatility, also known as risk, enables you to earn a better return over the long run. You wouldn't earn the six-percentage-point equity risk premium in stocks if you weren't exposed to lots of volatility. It just goes with the territory. It’s part of owning a risk asset.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

©2021 Advisor Products Inc. All Rights Reserved.

More articles

- The Facts Amid Rising Fears Of Inflation

- New Identity Fraud Tactic Targets Amazon Prime Users

- A Professional Perspective On 2020, The Cruelest Year

- Viewing Financial News Through The Long Lens Of History

- Act Before Hitting The Crossroad Of Fiscal And Tax Reality

- The Bull Market Broadened Recently

- An Important Investment Idea To Remember In 2021

- New Covid Aid Law Waives 10% Penalty On Pre-59½ Retirement Plan Withdrawals

- What Business Owners Need To Know About The New Aid Package

- A Call To Act On The Coming Tax Hikes

- Staying Focused On Strategic Financial Planning

- Will M2 Be The Big Investment Story Of 2021?

- Test Your Knowledge Of Urgent Wealth Management Issues

- Neither Red Nor Blue, Tax Planning Is All About The Green

- Urgent Year-End Tax Planning Moves