Planning Briefs

Neither Red Nor Blue, Tax Planning Is All About The Green

Published Tuesday, November 17, 2020 at: 10:04 PM EST

Here's a chance for us all to come together. No matter whether you voted Red or Blue, tax planning is about green!

Whether you like Biden or Trump, you probably want to pay as little tax as possible. Assuming that's true, this is an urgent and important tax alert, and a call to act before the end of 2020.

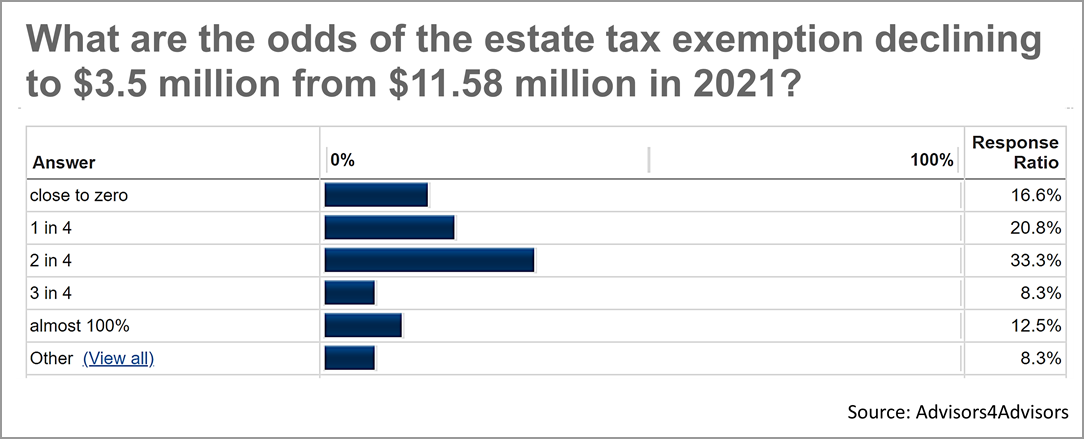

A majority of financial professionals expect estate taxes will be hiked in 2021. This could be a really big deal to your family. Specially, more than half of advisors surveyed at a continuing education class for tax and financial planning professionals expect the estate tax exemption will be slashed from $11.5 million to $3.5 million.

To be clear, failing to plan for what's expected to happen by a majority of tax and financial planners could mean paying tens of thousands of dollars or more in estate taxes. But it requires acting by the end of 2020, which is closing in fast.

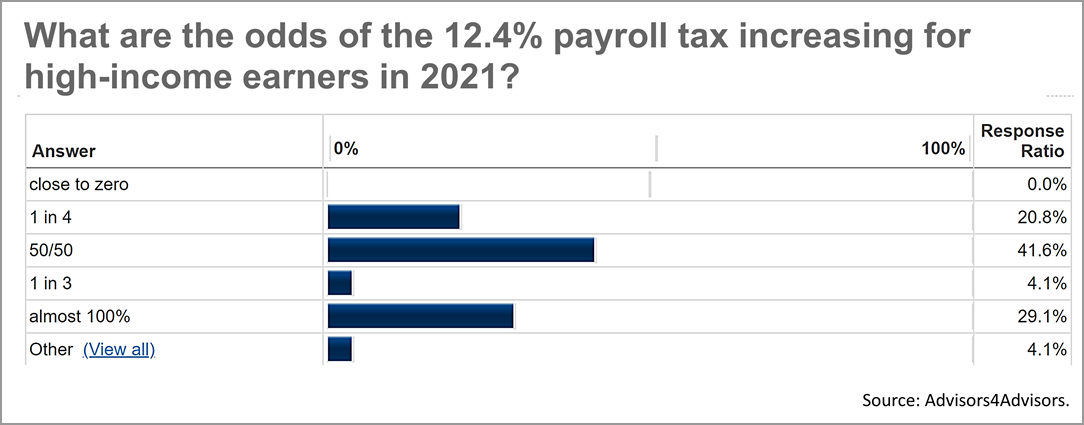

In addition to the expansion of the estate tax, the payroll tax is widely expected to be expanded to millions of high-income earners. According to Advisors4Advisors, a popular news and education service for tax and financial planning professionals, 75% of practitioners believe the payroll tax will also be hiked on high-income earners in 2021.

Doctors, dentists, audiologists, and other professionals as well as business owners who earn more than $400,000 are targeted for a 12.4% payroll tax increase in 2021 under President-elect Biden's tax plan, according to the Biden campaign website.

No matter your political leanings, the need for action by the end of the year by high-net worth and high-income individuals is urgent.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. It does not take into account your investment objectives, financial or tax situation, or particular needs. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. The material represents an assessment of financial, economic and tax law at a specific point in time and is not a guarantee of future results.

©2020 Advisor Products Inc. All Rights Reserved.

More articles

- Urgent Year-End Tax Planning Moves

- Investors Beware: SEC Is Struggling Amid Covid

- Food For Thought

- Starting A Business? Plan To Succeed

- Stock Market Rally Broadened In Past Three Months

- 3Q 2020 Wealth Management Report

- Income, Estate And Gift Tax Hikes Ride On Election Results

- 2020 Year End Tax Planning For Retirees, Business Owners, And Families

- Set Your Financial Priorities Right Now

- Poor Bond Outlook May Herald A New Stock Valuation Regime

- Family Wealth Transfer Opportunities Spawned By Covid

- A Five-Point Covid Diagnostic For Family Wealth Management

- Private Wealth’s Perfect Storm

- Confronting Mortality's Details

- Anomalous Financial Economic Conditions Of The Covid Crisis