Planning Briefs

Do The Top 1% In Income Pay Enough Income Tax?

Published Wednesday, May 12, 2021 at: 6:13 PM EDT

Do the top 1% in income in America pay enough income tax? Here are the facts to decide.

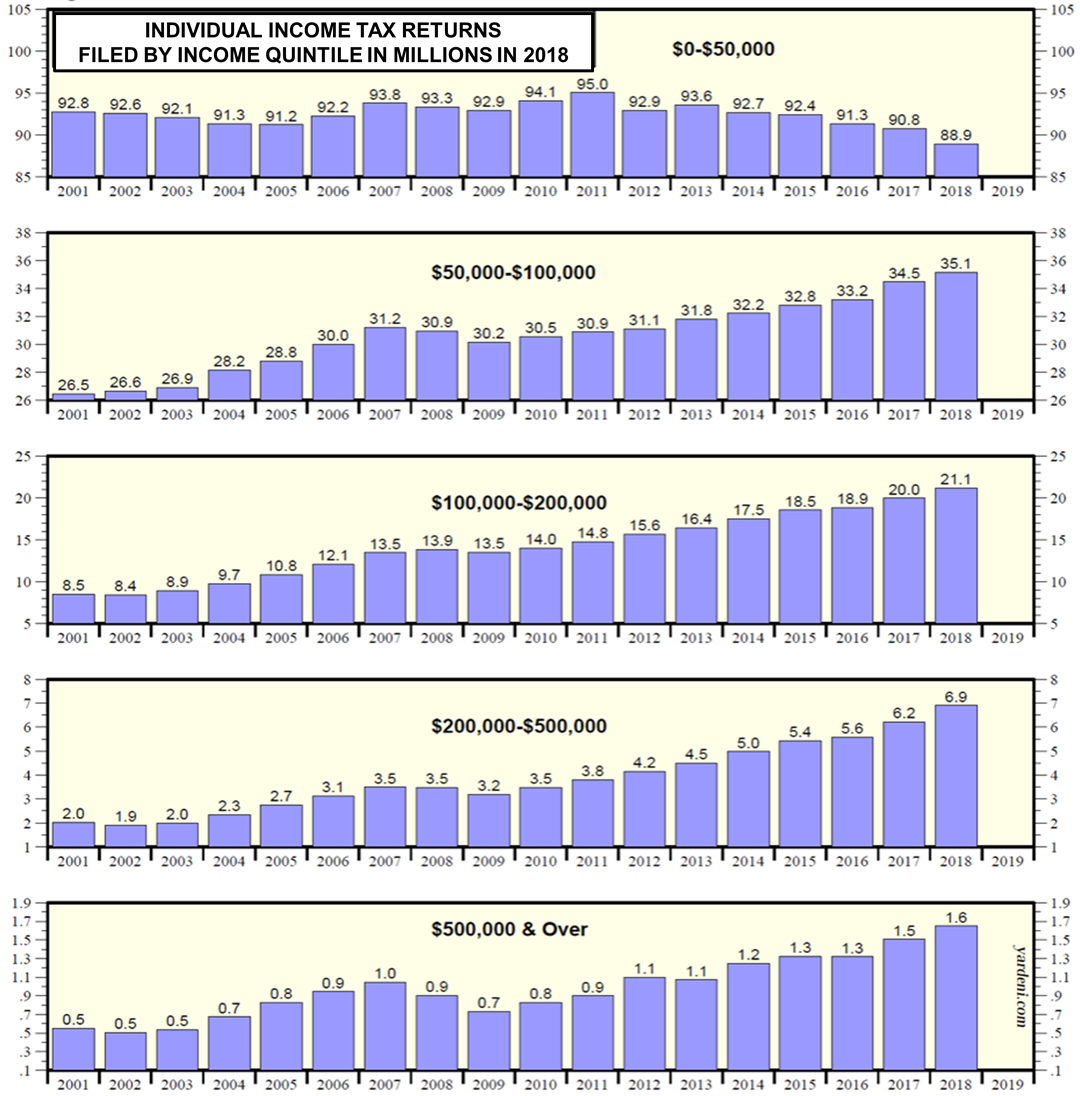

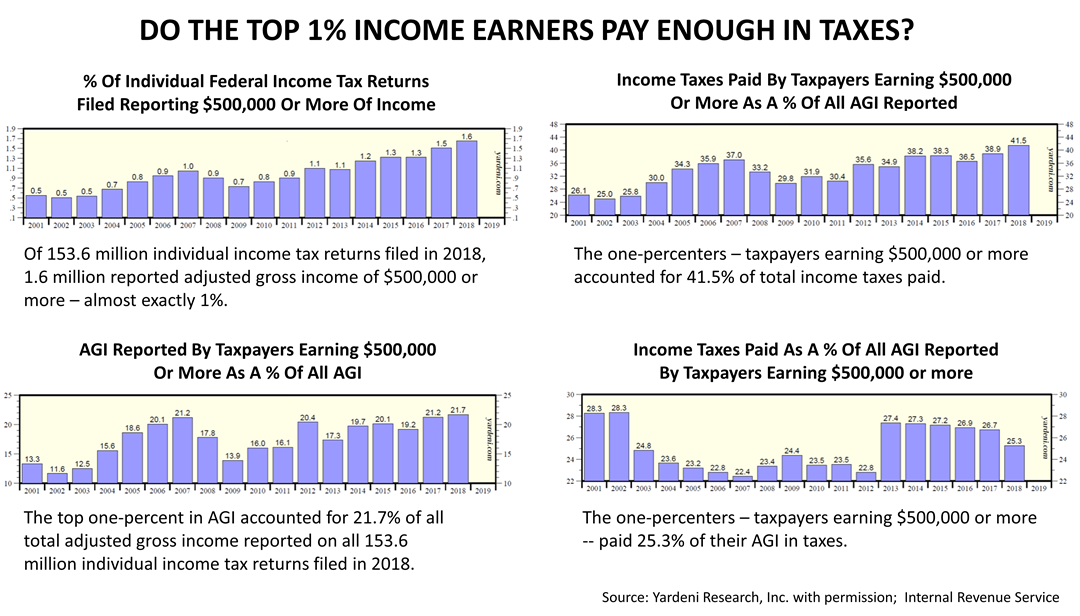

In 2018, the latest data from the Internal Revenue Service show 153.6 million individual income tax returns were filed. Of those returns, 1.6 million reported adjusted gross income of $500,000 or more. Thus, almost exactly 1% of individual returns filed in 2018 reported income of $500,000 or more. Using income as a gauge of wealth, rather than net worth, these are the “one-percenters.”

The one-percenters – taxpayers earning $500,000 or more in adjusted gross income -- accounted for 21.7% of total adjusted gross income reported on all 153.6 million individual tax returns filed.

They accounted for 41.5% of total income taxes paid and they paid 25.3% of their adjusted gross income in taxes 2018, less than they paid before the tax cut of 2017. Was that enough? It’s for you to decide, but those are facts.

No matter your answer, you can count on us for the facts and advice on the tax hikes on income and wealth almost certain to be enacted in 2021.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

©2021 Advisor Products Inc. All Rights Reserved.

More articles

- What’s The Risk Of A Market Melt-Up?

- U.S. Stocks Returned 10 Times More Than Bonds In Past Five Years

- Stock Market Trend Report

- Two Observations That May Make Higher Taxes Easier To Bear

- John Oliver's Economic Analysis Is No Joke

- Are You A Risk To Your Financial Health?

- News Analysis: Today’s Testimony By The Fed Chair And Treasury Secretary

- Pandemic Financial Pain Is A Thing

- Capitalizing On Current Financial Economic Trends

- The Cost Of Not Having A Financial Plan Is Surging

- Equity Risk Premium Grew Wider And More Important

- The Facts Amid Rising Fears Of Inflation

- New Identity Fraud Tactic Targets Amazon Prime Users

- A Professional Perspective On 2020, The Cruelest Year

- Viewing Financial News Through The Long Lens Of History