Planning Briefs

Stock Market Trend Report

Published Tuesday, April 20, 2021 at: 8:03 PM EDT

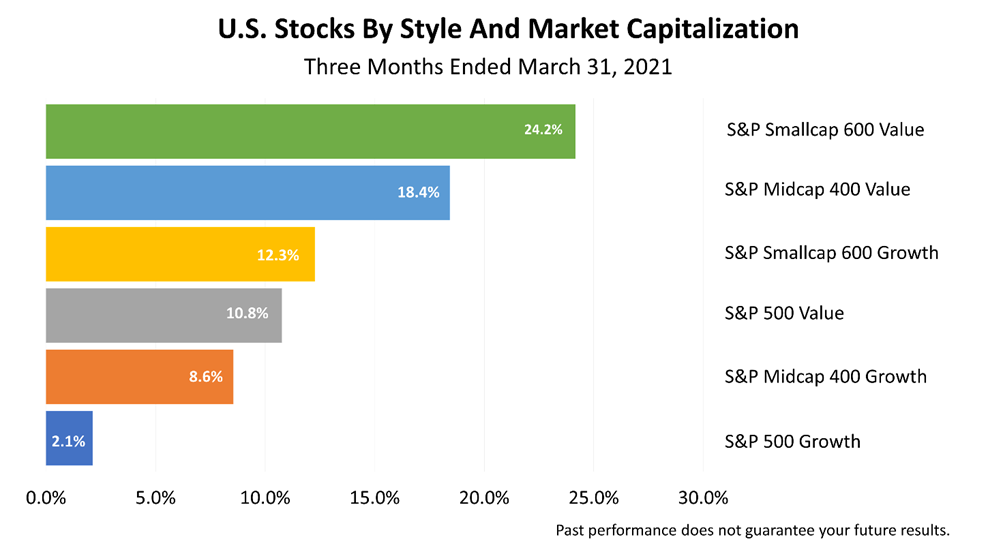

While a single quarter of data is usually not elucidating – it’s just not enough time and data to make a sweeping conclusion -- sometimes a single quarter tips you off to a shift in investor preferences. That’s true in this three-month snapshot. It shows the stock market investments classifying companies by market capitalization and style.

The fact that small-cap value led the market last quarter marked a reversal of the pandemic boom in which the super-cap growth stocks, like Amazon, Apple, Facebook, Microsoft, Netflix and Google, dominated returns and temporarily distorted the performance of the S&P 500 index.

Many stocks in the blue-chip Standard & Poor’s 500 index were weak relative to the tech giants earlier in the pandemic. The tech giants grew stronger during the pandemic because their solutions were used more than expected, triggering larger than expected profits in a handful of super-large cap stocks.

Since the S&P 500 index is market-weighted, the price surge in the super-large tech companies became more influential in the S&P 500 index. That trend was reversed last quarter and again in the first quarter of 2021 ended March 31, 2021.

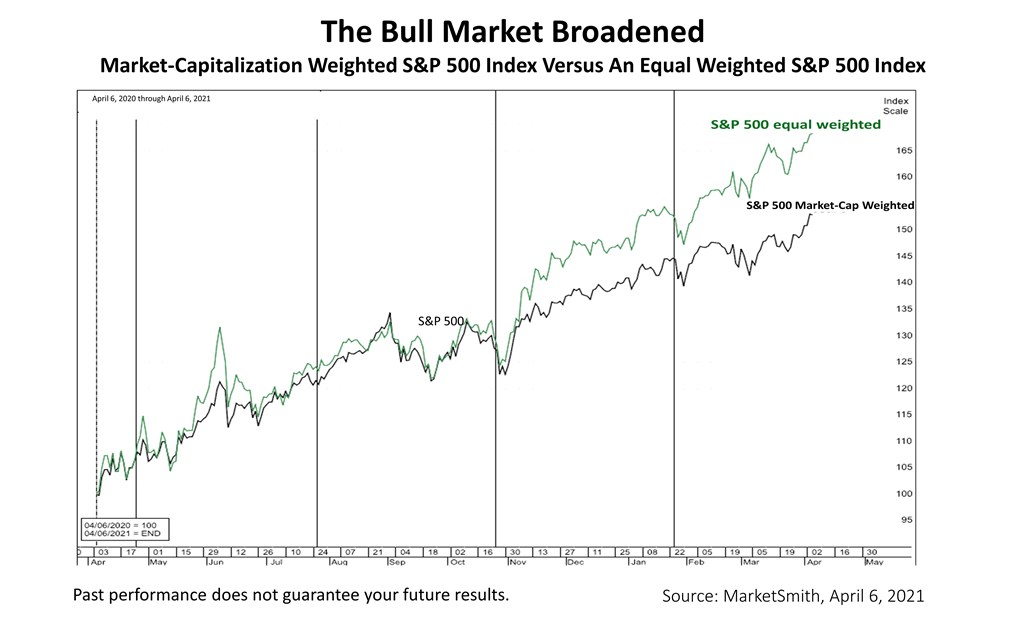

Since the election, the bull market broadened out. Value and small-cap stocks have surged. In this chart, the equal-weighted Standard & Poor’s 500 stock index is outperforming the market-capitalization weighted S&P 500 index, which is commonly quoted and the main benchmark of U.S. stock performance.

Investors have viewed the election of President Biden in very positive terms, undoubtedly because of the enormous fiscal stimulus the new administration is pursuing. The larger role played by the government in responding to the Covid economic crisis will be subject to political debate. No matter your politics, however, the broadening of the bull market is a good trend for stock market investors.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

©2021 Advisor Products Inc. All Rights Reserved.

More articles

- Two Observations That May Make Higher Taxes Easier To Bear

- John Oliver's Economic Analysis Is No Joke

- Are You A Risk To Your Financial Health?

- News Analysis: Today’s Testimony By The Fed Chair And Treasury Secretary

- Pandemic Financial Pain Is A Thing

- Capitalizing On Current Financial Economic Trends

- The Cost Of Not Having A Financial Plan Is Surging

- Equity Risk Premium Grew Wider And More Important

- The Facts Amid Rising Fears Of Inflation

- New Identity Fraud Tactic Targets Amazon Prime Users

- A Professional Perspective On 2020, The Cruelest Year

- Viewing Financial News Through The Long Lens Of History

- Act Before Hitting The Crossroad Of Fiscal And Tax Reality

- The Bull Market Broadened Recently

- An Important Investment Idea To Remember In 2021